Multiple arbitrage looks good on paper: buy small businesses at low EBITDA multiples, bolt them together, and exit the combined group at a higher multiple. No product innovation, no new markets, just valuation math. But in practice, multiple arbitrage risks make this strategy far more fragile than it seems.

What is multiple arbitrage? It is a strategy often used in private equity, in which an investor acquires companies at lower valuation multiples (such as EBITDA multiples), integrates them into a platform, and seeks to sell the combined entity at a higher multiple. The value creation relies heavily on market perceptions, scale benefits, and the expectation that larger, well-managed businesses command premium valuations.

But reality gets in the way.

Market shifts, failed integrations, and overly optimistic assumptions often erase the value arbitrage is supposed to create. In today’s environment, it’s not just about finding the right targets. It’s about what happens after the deal closes.

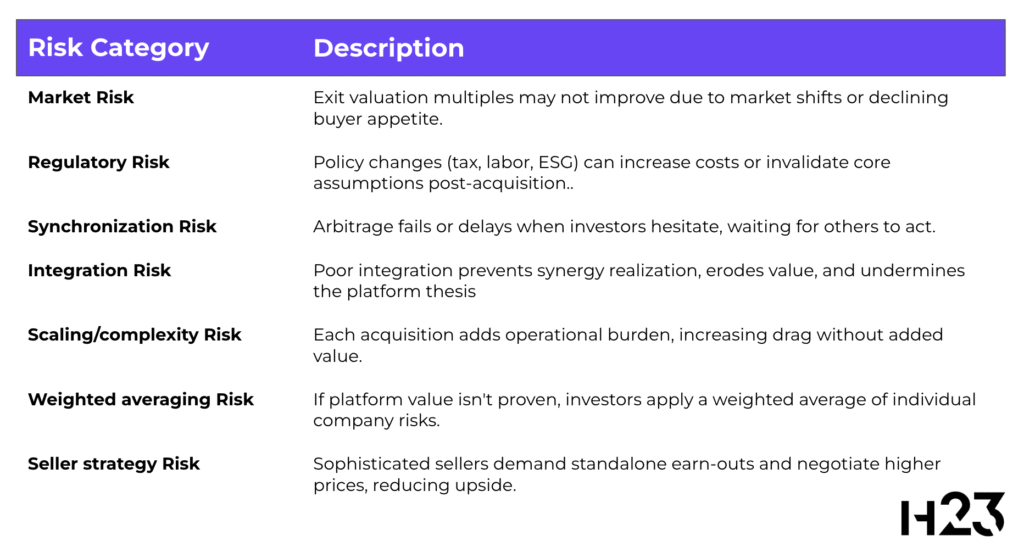

There are multiple risks related to this strategy. Let’s dissect them one by one.

1. Exit multiples may not materialize

Most teams model the exit based on a higher multiple than they paid. The core risk is that the market fails to reward the combined entity with an elevated multiple. If market sentiment shifts or sector headwinds arise, exit valuations can suffer, negating anticipated gains.

Bain points out that more deals are now closing with flat or declining multiples. In less favorable markets, even well-executed rollups can struggle to find buyers willing to pay a premium. A peer-reviewed study found that arbitrage contributed just 8% to value creation in buy & build strategies. Less than expected and heavily market-dependent.

If your strategy relies on someone else paying a higher multiple later, it’s not value creation. It’s timing

2. Regulatory changes disrupt value assumptions

Even well-structured arbitrage plays can be disrupted by regulatory changes that alter the economics of an industry overnight.

A new tax rule, labor law, or licensing requirement can:

increase compliance costs

delay acquisitions

reduce margins or cash flow predictability

These effects hit platforms harder. Why? Because you’re operating across more entities, jurisdictions, and legal setups. All of which multiply exposure. If your arbitrage logic assumes a stable external environment, it only takes one policy change to unravel the math.

This isn’t hypothetical. In recent years, shifts in healthcare regulation, ESG mandates, and local labor rules have directly impacted the viability of rollups across Europe and North America.

3. Investor hesitation delays value realization

There’s also a less obvious financial risk: synchronization.

Even when an arbitrage opportunity exists, investors may hesitate to act if they’re unsure when others will do the same. This is known as synchronization risk, and it means that price convergence might take longer than theory predicts, or never fully materialize.

In practice, that delay creates friction: misaligned execution, prolonged integration drag, and a longer wait for valuation uplift. If it comes at all.

4. Poor integration destroys expected value

One of the most overlooked multiple arbitrage risks is poor integration. Successfully realizing higher multiples depends on effective integration: operational, technological, and cultural. Failed integrations can erode value, resulting in “arbitrage drift”—where the average multiple of the combined businesses is lower than expected. Additionally overly optimistic synergy projections can lead to value destruction if cost savings, cross-selling, or margin improvements do not materialize as planned.

You can’t call something a platform if it runs five sets of systems, uses different org charts, and sends customers mixed signals. In those cases, investors won’t price the group at a premium. Instead they’ll discount it for complexity.

Many buy & builds never become true platforms. They stay fragmented and synergies are assumed, not measured.

5. Arbitrage doesn’t scale. Complexity does

Even if arbitrage works early on, it rarely holds up as deal count grows. Each new acquisition adds integration debt: more systems, more reporting friction, more cultural gaps.

Without a clear operating model and tight integration governance, the effort to align businesses starts to outweigh the value they bring.

6. Market applies weighted average multiple at exit

When integration fails, and the risk profile or weaknesses of the acquired companies remain visible, the market may not apply a higher, platform-level multiple at exit.

Instead, investors often apply a weighted average multiple based on the performance and risk of each underlying business.

This cancels out the arbitrage logic. If your platform is made up of average assets that remain loosely connected, you won’t get rewarded for size. You’ll get priced based on the weakest links adjusted for complexity.

In other words: if the businesses you bought are still operating independently, with no real integration or shared value, you’ll exit at 6x—not 10x. And you’ll still carry the cost and complexity of trying to be a platform.

7. Smarter sellers reduce arbitrage upside

Sellers are also getting smarter. Many now negotiate earn-outs based on standalone performance, not group-level results—anticipating that synergy stories may never play out.

And if I’m being honest: I’d recommend the same if I were advising the seller when the buyer fails to show clear integration and value creation plan.

What’s more, as sellers increasingly understand how the private equity game works, they begin to price in part of the arbitrage themselves. They’re not just selling today’s value, they’re negotiating for a share of the platform’s future upside.

The result: arbitrage gets squeezed before you even start integrating.

5 red flags you’re leaning too hard on arbitrage

So those are the risks. How do you spot when arbitrage is driving more of your thesis than it should?

Red flags:

Why it matters:

- Most of your IRR depends on exit multiple expansion

- That’s speculation, not strategy

- No integration budget or leadership team in place

- You’re not ready for what you just bought

- No baseline for tracking synergies

- You won’t know if you’re winning or losing

- Fragmented data and reporting

- Investors will see chaos, not scale

- No plan for culture or org design

- Internal resistance will block execution

When multiple arbitrage strategies can actually work

This isn’t a call to kill arbitrage. It’s a call to get smarter about it.

It can work when:

You’re in a fragmented, under-digitized market

You acquire undervalued or underperforming assets

You have a playbook for integration that’s been stress-tested

- You have platform operating model in place (check our recommendation here)

You build real capabilities—not just an investment thesis

But if arbitrage is the story, and not the result of deeper strategic work, you’re betting on investor psychology, not business fundamentals.

Final thought on managing multiple arbitrage risks

Multiple arbitrage risks can destroy all plans made in excels. Multiple arbitrage is more a financial tool, than a value creation strategy. Used well, it can amplify strong fundamentals. But on its own, it may fail.

If your platform is built on the hope that someone else will pay more for it later, ask yourself what they’re really buying?

Reference:

Bain & Company. (2024). Building a Stronger Buy-and-Build. In Global Private Equity Report 2024. Retrieved from bain.com/insights/building-a-stronger-buy-and-build-global-private-equity-report-2024/

Cairnstone Equity. (2024, December 12). Multiple Arbitrage: A Private Equity Strategy Sellers Must Understand. Retrieved from cairnstone-equity.com/post/multiple-arbitrage-a-private-equity-strategy-sellers-must-understand

Dávila, E., Graves, D. D., & Parlatore, C. (2022). The Value of Arbitrage (NBER Working Paper No. 29744). Retrieved from nber.org/system/files/working_papers/w29744/w29744.pdf

Abreu, D., & Brunnermeier, M. K. (2002). Synchronization Risk and Delayed Arbitrage. Journal of Financial Economics, 66(2–3), 341–360. Retrieved from princeton.edu/~markus/research/papers/synchronization_risk.pd