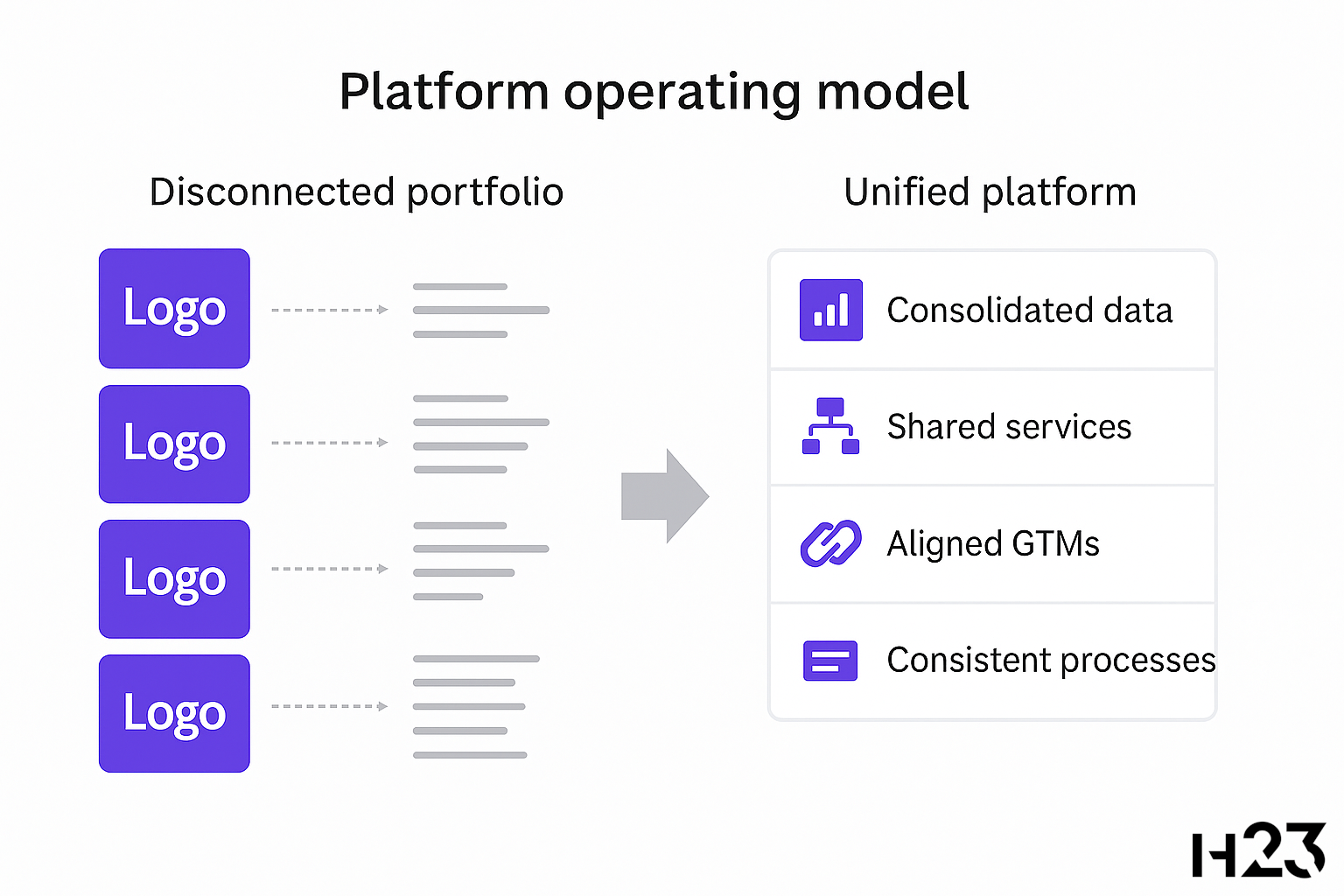

Buy & build strategies promise scale, speed, and efficiency. But after the deals are signed, the real challenge begins: turning a portfolio of acquisitions into one cohesive company.

Too often, the group ends up operating as a loosely connected set of businesses. Each with its own systems, teams, processes and logic. The result? Missed synergies, duplicated effort, and a platform that never quite materializes.

If you don’t evolve the operating model, you don’t create value. You just collect companies.

The risk of staying a portfolio

Acquiring businesses is only step one. Without integration, you don’t gain leverage, you gain complexity.

Finance can’t consolidate data without shared systems

Sales teams can’t cross-sell if GTMs aren’t aligned

Leadership can’t steer the ship if every unit moves differently

Investors lose confidence when there’s no clear integration roadmap

I’ve seen integration strategies stall for a full year because teams couldn’t agree on a shared definition of profitability. Not because people were incompetent, because each business had its own legacy reporting, culture, and incentives. Without a plan to converge, even the basics become negotiations.

What a platform operating model actually looks like

It’s not about rigid centralization. It’s about structured coherence, creating consistency where it matters most, and flexibility where it adds value.

Key components of a scalable operating model:

Standardized core processes in finance, HR, operations, and sales

A core vs. edge model: define what’s group-wide vs. what stays local

Shared KPIs and decision rights using group-wide RACI frameworks

Integration middleware (e.g. MuleSoft, Boomi) to connect systems before full migration

Use of shared service hubs to speed up execution and reinforce shared culture

Most companies try to delay operating model design until long after acquisition. That’s a mistake. From my experience, the longer you wait, the harder it is to align mindsets. Founders or local GMs begin to believe their system is the company. Changing that belief later is expensive and political.

Where it often breaks down

Even experienced groups fail to operationalize their strategy. Here’s why:

Every acquired company is treated as “special”

Financial integration is prioritized, while ops, data, and culture lag

Local systems and workflows are left untouched for too long

Complexity accumulates until integration becomes too expensive to start

This is what I call invisible complexity. On the surface, everything looks fine. Companies are still operating, revenue is growing. But underneath, workflows break down. Teams lose visibility. Eventually, this turns into execution drag: slower launches, internal blame loops, and poor decisions based on incomplete data.

A phased model that actually works

Phase 1 – Strategic clarity:

Run a target integration scorecard before every deal: cultural fit, data quality, complexity

Use Day 100 heatmaps to predict impact zones (where resistance and disruption will show up first)

I believe this is the most underrated part of integration planning. We tend to focus on synergies and cost structures, but the real friction comes from human systems, reporting flows, decision bottlenecks, incentives. That’s where impact happens first.

Phase 2 – Operating blueprint:

Build an Operating Model Canvas to define governance, capabilities, systems, and flow

Design a core vs. edge map. Identify non-negotiables (e.g. financial close process, HRIS) vs. local flexibility

Don’t just centralize. Clarify. If everyone knows what’s fixed and what’s flexible, you remove 80% of day-to-day ambiguity.

Phase 3 – Leadership & cadence:

Install a Chief Integration Officer with clear mandate beyond finance

Launch integration sprints (2–4 weeks) focusing on GTM alignment, shared CRM, procurement policies

Integration sprints force focus. Instead of vague “alignment,” you target one system, one process, or one barrier—and break it down.

Phase 4 – Capability building:

Coach acquired leaders to become platform players, not standalone CEOs

Define integration KPIs and track adoption (e.g. % shared systems, % standard processes)

You can’t scale if your leaders still behave like independent operators. Platform thinking is a skillset and a shift in identity.

Signals your model isn’t working yet

Monthly reports arrive as PowerPoints, not system-driven dashboards

Each unit uses its own pricing logic and GTM model

Org charts are unclear, duplicated, or politically sensitive

Decisions are relitigated across layers, no one knows who owns what

Leaders struggle to tell one clear story about the group

These are more than signs of operational mess, they’re signs that your integration has stalled. If you’re seeing these, you’re no longer in post-merger mode. You’re in pre-chaos.

From deal logic to operational logic

The B&B strategy doesn’t fail in the deal room.

It fails in execution, when there’s no model behind the ambition.

You promise cost synergy, but forget that procurement is still decentralized

You promise revenue synergy, but teams are still incentivized in silos

You promise a platform, but act like a holding company

Every acquisition should make the system stronger, faster, and more scalable.

And the only way to do that is by building a platform, not just a portfolio.